Transfer of Property After Death Without Will in Texas

In Texas, dying without a will—known as “intestacy”—means the state decides who inherits your property. This process follows a Texas intestate succession chart, which outlines how assets get divided among spouses, children, and other relatives. Since roughly half of Americans never draft a will, understanding transfer of property after death without will in Texas is crucial for heirs and administrators alike.

Below, we’ll break down the basics of Texas intestate succession, explore common family scenarios, and clarify how real estate transfers occur when no valid will exists. If you’re also curious about the broader probate process, for an overall probate guide, see Texas Probate Real Estate 101.

Definition of Intestate Succession & Why It Matters

When someone dies intestate, they leave no legally enforceable will or estate plan to dictate asset distribution. In these cases, Texas law steps in with a prescribed formula that designates who inherits and in what proportions. This statutory framework helps prevent chaos or unfairness, but it doesn’t always reflect what the deceased would have personally chosen.

Heirs and beneficiaries should grasp how property is passed down under intestate succession to avoid confusion or disputes. Even seemingly simple estates can involve multiple family branches—especially if there were marriages, divorces, or children from previous relationships.

Texas Intestate Succession Basics

Texas law uses a priority system for dividing assets when there’s no valid will. While the specifics can get complicated, here are the fundamentals:

Spouse, Children, and Other Relatives

- Surviving Spouse

- If the decedent was legally married at the time of death, the spouse typically inherits a significant share of the community property.

- However, the spouse’s share of separate (non-community) property can vary, especially if there are children from prior marriages.

- Children

- Biological and legally adopted children usually have an automatic right to inherit a portion of the estate.

- Stepchildren or foster children who were never legally adopted typically do not inherit unless they can establish a special legal relationship.

- Other Relatives

- If there’s no surviving spouse or children, the intestate succession chart moves to parents, siblings, grandparents, aunts/uncles, and more distant relations.

- The further down the family line you go, the more complicated it can become to locate all eligible heirs.

For more detail on whether a will is required for every situation, learn if all wills require probate in Do All Wills Go Through Probate?

Common Scenarios

Below are typical family structures where transfer of property after death without will in Texas can get tricky:

Married with Kids

- Community Property: Typically includes assets acquired during marriage. If all children belong to the surviving spouse, the spouse generally keeps all community property.

- Separate Property: Anything owned before marriage or inherited individually could be split between the spouse and children. The spouse might receive one-third, while children share the remainder.

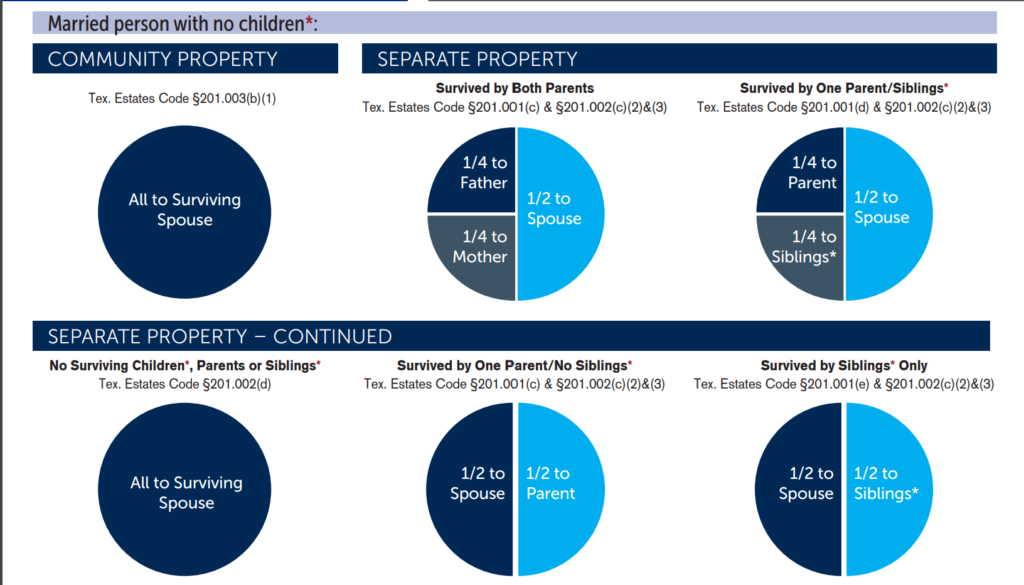

Married without Kids

- If the deceased leaves no children, the surviving spouse often receives all community property. However, separate property might be split with other relatives (e.g., the decedent’s parents or siblings) under certain conditions.

Unmarried, No Children

- When there’s no spouse or offspring, the law looks to parents, siblings, and extended family. If none exist, assets may “escheat” to the state—which means the state of Texas ultimately inherits.

Because family arrangements can be complex, verifying your exact share often requires legal guidance. If you’re seeking to manage the estate as an administrator, see How to Become Executor of Estate for the appointment process, even if there’s no will.

Transfer of Real Estate

Real estate is often the most valuable asset in an estate. Without a will specifying who inherits the property, the intestate succession chart determines who’s entitled to it. Yet the actual transfer involves more than just a formula.

Deeds and Property Title Issues

Ownership of a home or land does not automatically shift to heirs the moment someone passes. Rather, the title remains in limbo until you clarify heirs through court procedures or recognized legal documents. If you plan to sell or mortgage the property later, you must ensure the title is correctly updated to reflect the rightful owners.

Affidavit of Heirship

One popular way to document heir status in Texas is using an Affidavit of Heirship. Two disinterested witnesses—people who aren’t inheriting but know the family situation—sign a sworn statement detailing the decedent’s heirs. The affidavit is then recorded with the county. While it doesn’t hold the same weight as a formal court order, an Affidavit of Heirship can be enough for some title companies to transfer ownership. It’s commonly used when the estate is relatively simple and heirs don’t expect disputes.

For more on which assets might skip probate altogether, discover which assets avoid probate in Probate vs. Non-Probate Assets.

Formal vs. Informal Procedures

Sometimes, an informal step like an Affidavit of Heirship suffices. But in other cases, especially with larger or disputed estates, you’ll need a more structured approach.

Court-Supervised Distribution

In more complicated estates or those with significant debt, the probate court will supervise the entire distribution. A court-appointed administrator may need to collect property, pay off creditors, and distribute any remainder among the heirs. This process offers legal certainty but can be more time-consuming and costly. Disputes—over paternity, marital status, or which assets are community vs. separate—often arise here.

Small Estate Affidavits

For estates under a certain value threshold, Texas law allows a Small Estate Affidavit to bypass full probate. This document lets heirs claim the deceased’s assets if no serious debts or complicated issues exist. However, it has specific requirements and often doesn’t address real estate except under limited conditions (like a homestead scenario). Double-check county regulations or consult an attorney to confirm eligibility.

If you’re navigating property transfers without a will, the court might ask for a straightforward outline of your relationship to the deceased. In more straightforward cases, this can be faster than a full probate administration. However, always ensure that no other potential heir might contest your claim.

Dying without a will doesn’t mean the property automatically disappears or heads straight to the government. Texas intestate succession laws provide a roadmap for who inherits and in what proportions. Understanding these rules is crucial if you’re dealing with transfer of property after death without will in Texas—especially when real estate is involved. From spouse and children’s rights to more distant relatives, the legal framework ensures someone receives what the decedent leaves behind. Yet the process can still be intricate, requiring documents like Affidavits of Heirship or formal court-supervised distribution in certain cases.

If you need guidance to navigate intestate probate or real estate transfers in Houston Area or anywhere in Texas, DHS Realty Group is here to help. We assist heirs in clarifying their rights, resolving title issues, and ensuring property is distributed smoothly. Call us at 602-327-1244 or reach out online to discuss your situation. With the right strategy, you can honor your loved one’s legacy while respecting everyone’s legal entitlements.

o1